Update I: A Journey to the Heart of the EU from London…

Wednesday, September 9, 2015 at 3:50PM

Wednesday, September 9, 2015 at 3:50PM After leaving London and the UK, although France is officially the second country that we cycled through, less than 20kms and barely an hour of pedalling under a grey sky on Sunday morning didn’t really justify a full blog. We crossed the border into Belgium just east of Dunkirk, (in)famous for the British retreat in 1940, entering the country from which the EU policies are formulated. Ironic perhaps that the country at the heart of the European Union is itself clearly divided, holding the current world record for a being without a government, previously held by war-torn Iraq.

Cycling through a country gives you a sense of its history as well as geography. Part of the reason for this journey is to try and bring economics to life and highlight crucial links to the other humanities, a point arguably lost in the years running up to the 2007-2009 crisis.

Belgium itself is a relatively minor economy in the EU (15% of Germany) but it is the dominant force in the Benelux region. Its neutrality, geography and bilingualism made it a natural home, if there is one, for the EU to be based. In many ways the history of Europe can be told through its battles; from Caesar’s Gallic Wars to the Spanish and Austrian Successions in the 18th centuries. More recently, memorials of the great conflicts of the last two centuries are ubiquitous from Waterloo 200 years ago to Ypres in 1917 and Bulge in 1944.

Events in Europe have dominated headlines over the summer in the UK, led by Grexit and the migration crisis, both in the Med and (under) the channel. But the more important issue for UK economy and one that will rumble on during this economic cycle is whether Britain remains in the EU. Prime Minister David Cameron has promised a in/out referendum by the end of 2017.

My first job as a city economist back in 2002 at Schroders was to brief management on the economic implication of the UK joining the euro. The idea of the UK leaving the EU then was somewhat far-fetched. How things have changed!

So should Britain leave the EU? As always, the answer is not straight forward and depends on the terms that Cameron manages to negotiate. I’m not planning on going through all the arguments here - they are summarised well in this BBC article and some of the references below.

The main economic argument for leaving is saving money in membership fees - around £11.3bn in 2013 net of the rebate, according to the BBC. This is the equivalent to what the government spends on transport. The other arguments are hard to quantify but a trip to Brussels with my students in July highlighted the level of bureaucracy and the excessive cost of the administration (over $7bn!) - the parliament and its surrounding circus was in Strasbourg; it is surely a waste of money to have two parliaments?

What the EU budget is spent on Source: BBC

For me, the impact on trade and FDI into the UK are probably the most important arguments and it seems that it is simply not worth risking the negative impact on these two factors by deciding to leave. The EU represents around 50% of the UK’s trade and many multi-nationals have invested in the UK as a gateway to this market. Britain’s largely foreign owned Car and Financial industries are the two most obvious examples where millions of medium-term jobs would be at risk. For a more technical economic analysis of this, see the excellent blog from academics at the LSE, who find that ‘reduced integration with EU countries is likely to cost the UK economy far more than is gained from lower contributions to the EU budget’.

Source: Citi Economic Research

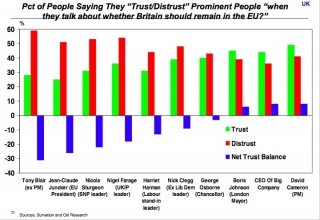

Either way, the UK's decision will be in the hands of the voters. As the chart above shows, if Cameron can negotiate what he wants, it should be a straightforward ’stay in EU’ decision. Politically, who leads the anti-EU campaign will be critical. Cameron will be laughing if it is Nigel Farage, untrusted by most voters (see chart below). However, if Boris decides to use this as a gamble to becoming the next PM, we can expect a bit of a bloodbath in the corridors of Westminster.

Source: Citi Economic Research

Europe today may not be much of a growth story but the EU represents nearly one quarter of the world’s wealth. The recent capitulation of Chinese markets highlight that emerging markets are perhaps not such a one-way bet. It will be fascinating to get to China next year and see the economy first hand!

In the meantime, we fly to Africa this week and will soon be exploring a couple of Belgium’s former colonies - Rwanda & the DRC. There, we’ll be investigating whether EU and other foreign aid is helping to make up for some of the damage caused by 'King Leopold’s ghosts'.

To find out more about the project, please visit their website:http://www.beyondthebike.org/

Reader Comments